Building Plans To Improve Lives

Blue Marsh Insurance is excited to announce our partnership with Thrive Wealth Management! At Blue Marsh, our goal has been to always provide our insurance clients with the ultimate protection, but also make available to them other related services that can help them along their life's journey.

Thrive Wealth Management was a natural fit for us and our clients, as they are a client focused firm, who specializes in a wide range of services like like Financial Planning, Investment Management, 401k Planning, Divorce Planning, and so much more.

Thrive Wealth Management was a natural fit for us and our clients, as they are a client focused firm, who specializes in a wide range of services like like Financial Planning, Investment Management, 401k Planning, Divorce Planning, and so much more.

If you are an Individual, Family or Business Owner and are looking for advice, or financial services from a team of people you can trust, Thrive Wealth Management is the only firm you need.

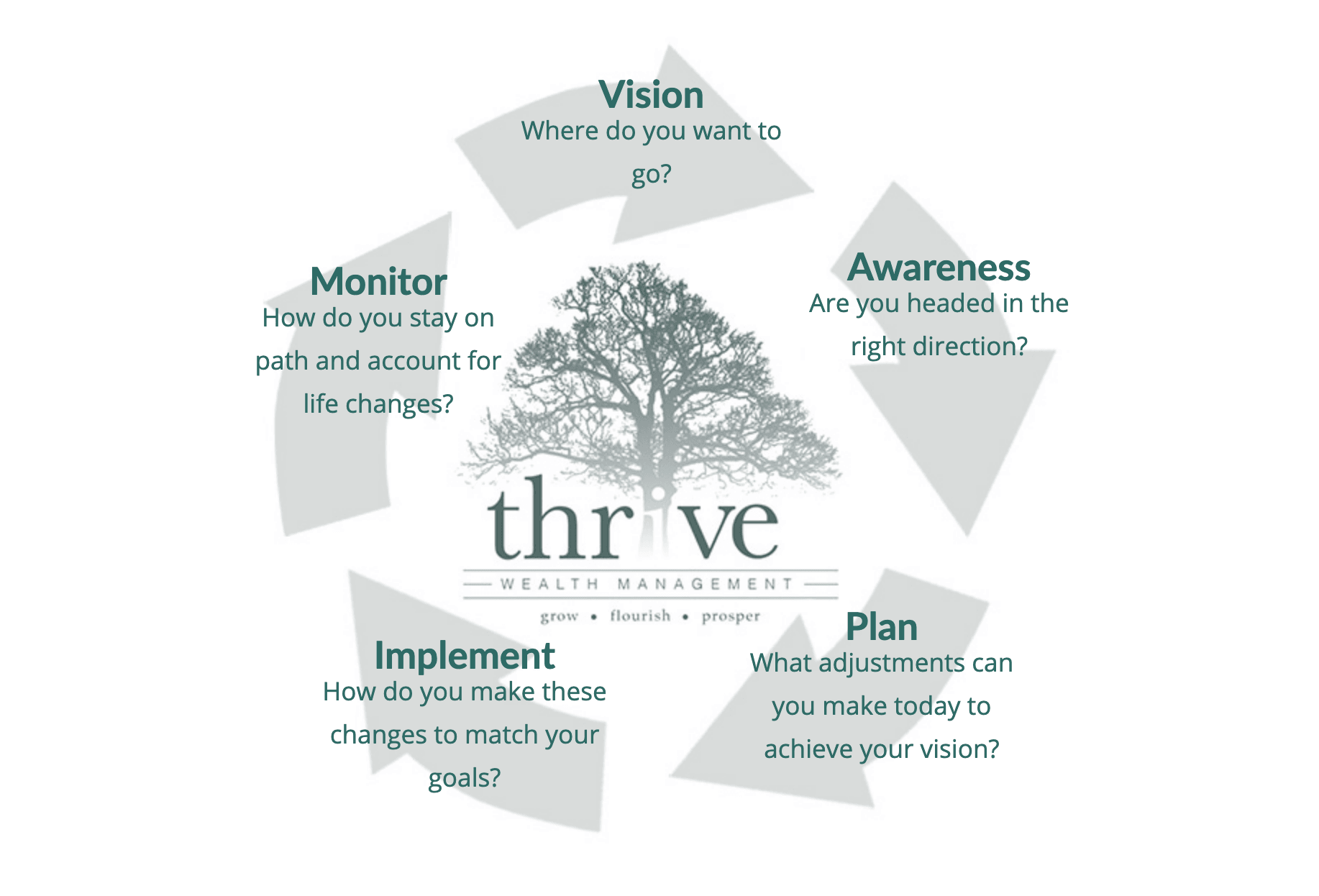

iThrive Life Planning Process™

The following disclosure is required by 64 Pa. Code Section 404.012. and by SEC Rule 275.206(4)-3:

Blue Marsh Insurance, Inc. (“Solicitor”), conducting business at 430 Park Road, Fleetwood, PA 19522 and 2501 Conestoga Avenue, Honey Brook PA, 19344, has entered into a Solicitor arrangement with Thrive Wealth Management, LLC (hereinafter “Investment Adviser”). In this transaction, Solicitor is being compensated by Investment Adviser for referring Client(s) to the Investment Adviser in accordance with the terms and conditions stated below. Relationship between Investment Adviser and Client: All investment advisory services will be provided to and referred Client by Investment Adviser. All investment advisory fees will be paid to Investment Adviser in accordance with the terms and conditions of the investment advisory agreement to be executed between Client and Investment Adviser. Concurrently with the delivery of this disclosure, Solicitor has delivered to Client a copy of Investment Adviser’s required disclosure, which details the services to be provided and the fees to be charged by Investment Adviser. Relationship between Solicitor and Investment Adviser: Solicitor and Investment Adviser are parties to a separate agreement in which Solicitor is compensated by Investment Adviser for soliciting clients for Investment Adviser. Investment Adviser has the right to accept or reject any client solicited by Solicitor. Solicitor is not an authorized agent of Investment Adviser, and has no right or authority to bind Investment Adviser to any contractual or legal obligation. Solicitor has no authority to make representations or warranties on behalf of Investment Adviser. Compensation for Solicitor: Solicitor is compensated by Investment Adviser on an ongoing basis from the fees Client will pay to Investment Adviser during the course of Clients relationship with Investment Adviser. Client will not pay any additional fees, and will not incur any additional costs, due to the compensation Investment Adviser pays to Solicitor.